- Published on

Building a Stock Screener Using Python and Streamlit

- Authors

- Name

- Mohit Appari

- @moh1tt

Introduction

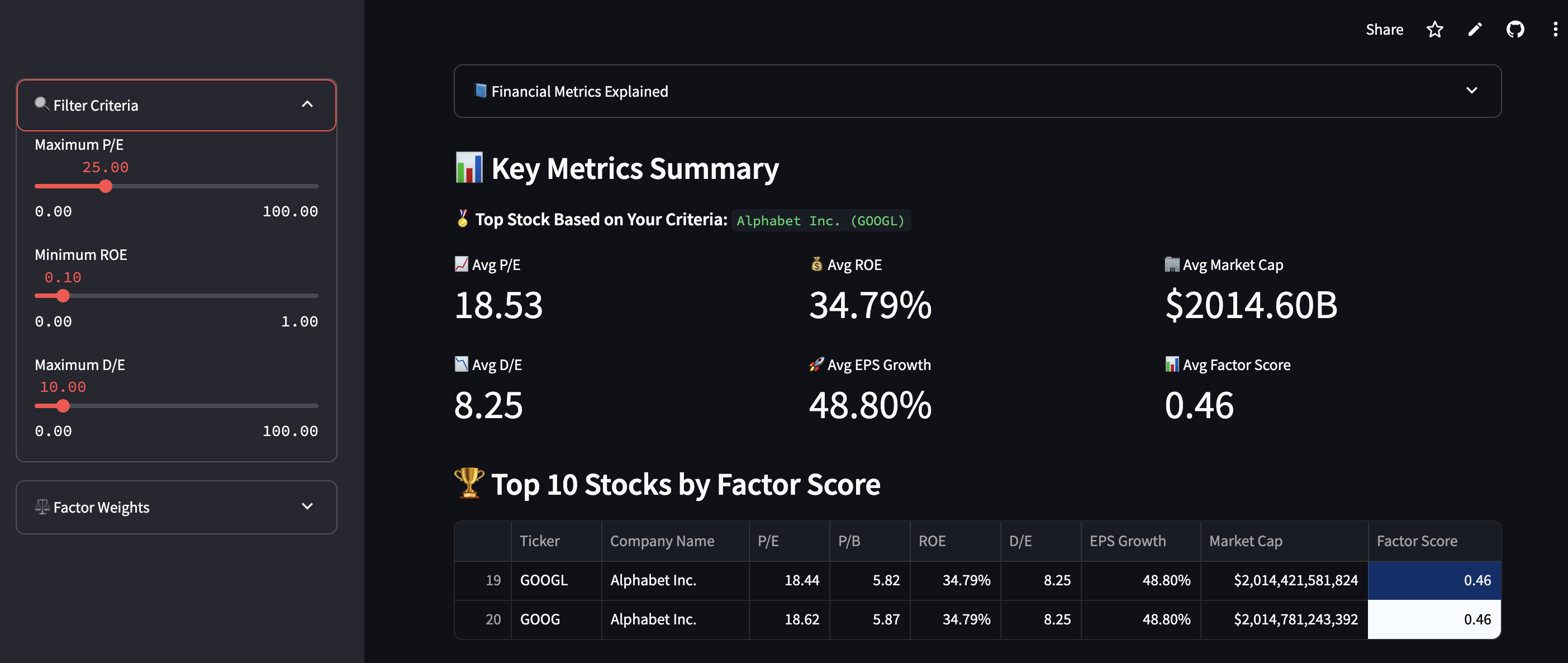

In this blog, we’ll explore how I built a Stock Screener — a tool that allows you to screen and rank S&P 500 stocks based on financial metrics like P/E, ROE, EPS Growth, and more. The project merges Python, data visualization, and financial analysis into a no-code, interactive web app powered by Streamlit.

Whether you’re a retail investor, finance student, or data science enthusiast, this app helps you make data-driven stock decisions with clarity and confidence.

Project Overview

This project focuses on factor-based investing — an approach used by quantitative hedge funds and asset managers to group and evaluate stocks based on characteristics like value, quality, and growth.

What You Can Do With It:

- Filter stocks based on:

- Price-to-Earnings (P/E)

- Return on Equity (ROE)

- Debt-to-Equity (D/E)

- EPS Growth

- Market Cap

- Assign custom weights to each factor and generate a Factor Score.

- View the top 10 ranked stocks and full filtered list.

- Visualize relationships between financial features using:

- Bar charts

- Scatter plots

- Bubble charts

- Market Cap histograms

- Plan your investment with an interactive savings allocator:

- Input your savings

- Get recommendations based on Value, Growth, and Quality strategies

Tools and Libraries

Streamlit– for building the web app UIPandas– data manipulationyfinance– stock data ingestionMatplotlib/Seaborn– visualizationsPython– the glue holding everything together

Install everything with:

pip install -r requirements.txt

GitHub Repository

📂 Check out the full code here: GitHub Repository

Key Features

1. 📊 Financial Filters

Users can interactively filter stocks by financial health indicators:

- P/E for valuation

- ROE for profitability

- D/E for risk

- EPS Growth for momentum

2. ⚖️ Custom Factor Scoring

You can assign weightage to each metric to match your investing style — whether you're value-driven, growth-focused, or somewhere in between.

3. 📈 Visual Analytics

The app comes with rich visualizations:

- Top 10 Stock Bar Charts

- ROE vs P/E Scatter Plot

- Market Cap Distribution

- Bubble charts for visual stock comparison

4. 💸 Investment Planner

Enter your total investable savings and get a personalized investment breakdown across:

- 🟦 Value (40%)

- 🟩 Quality (35%)

- 🟥 Growth (25%)

5. 📥 CSV Export

Download your filtered results with a single click to use in Excel, Tableau, or your own analysis workflows.

Challenges and Improvements

- 🔁 Live Data Delays: yfinance can occasionally throttle or slow down large requests. Caching helped speed up reruns.

- 📏 Outlier Handling: Extremely high or negative values needed to be clipped or filtered for better scoring logic.

- 🧠 Sector Awareness: Adding sector or industry filters could help build more specific screeners.

- 📉 Backtesting (Future): Being able to evaluate past performance of screened portfolios would take this to the next level.

Conclusion

This Stock Screener is more than just a coding project — it’s a data product designed to empower smarter investing. By combining financial theory with interactive technology, I created a platform that gives anyone the tools to think like a quant and act with insight.

What started as a learning project turned into a full-featured app that touches multiple aspects of finance, data science, and product thinking.

💬 Have feedback or ideas? Drop them in a GitHub issue or connect with me on LinkedIn!

Let’s build better tools for better investing. 🚀